The power of trading in flows

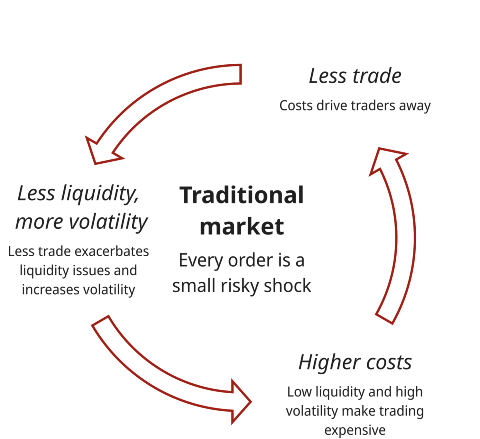

Traditional order books amplify volatility and trading risk, driving a negative feedback loop that undermines the market. Instead, trading through flows dampens risk and drives a virtuous cycle, enabling markets to thrive in spite of volatility and low liquidity.

Traditional order books often struggle in markets with high volatility and low liquidity. From finance to energy to crypto, examples abound of products with few or no orders and products with wildly fluctuating prices. For many of these products, the market fails not because of a lack of interest but because the dynamics of traditional order books make trading too risky and costly. A novel concept called flow trading—introduced by Kyle and Lee and developed further by Budish, Cramton, Kyle, Lee, and Malec—promises remarkable self-healing market dynamics.

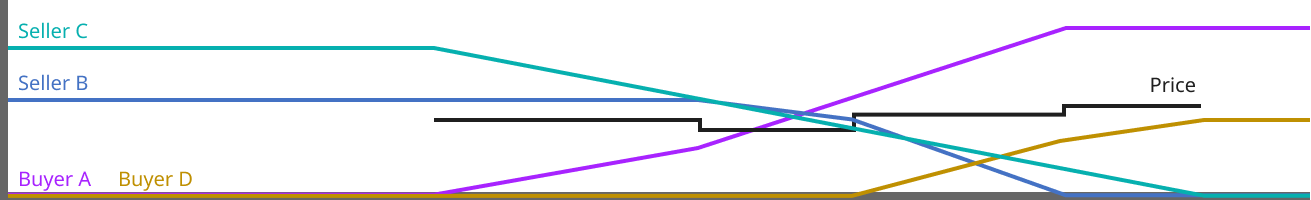

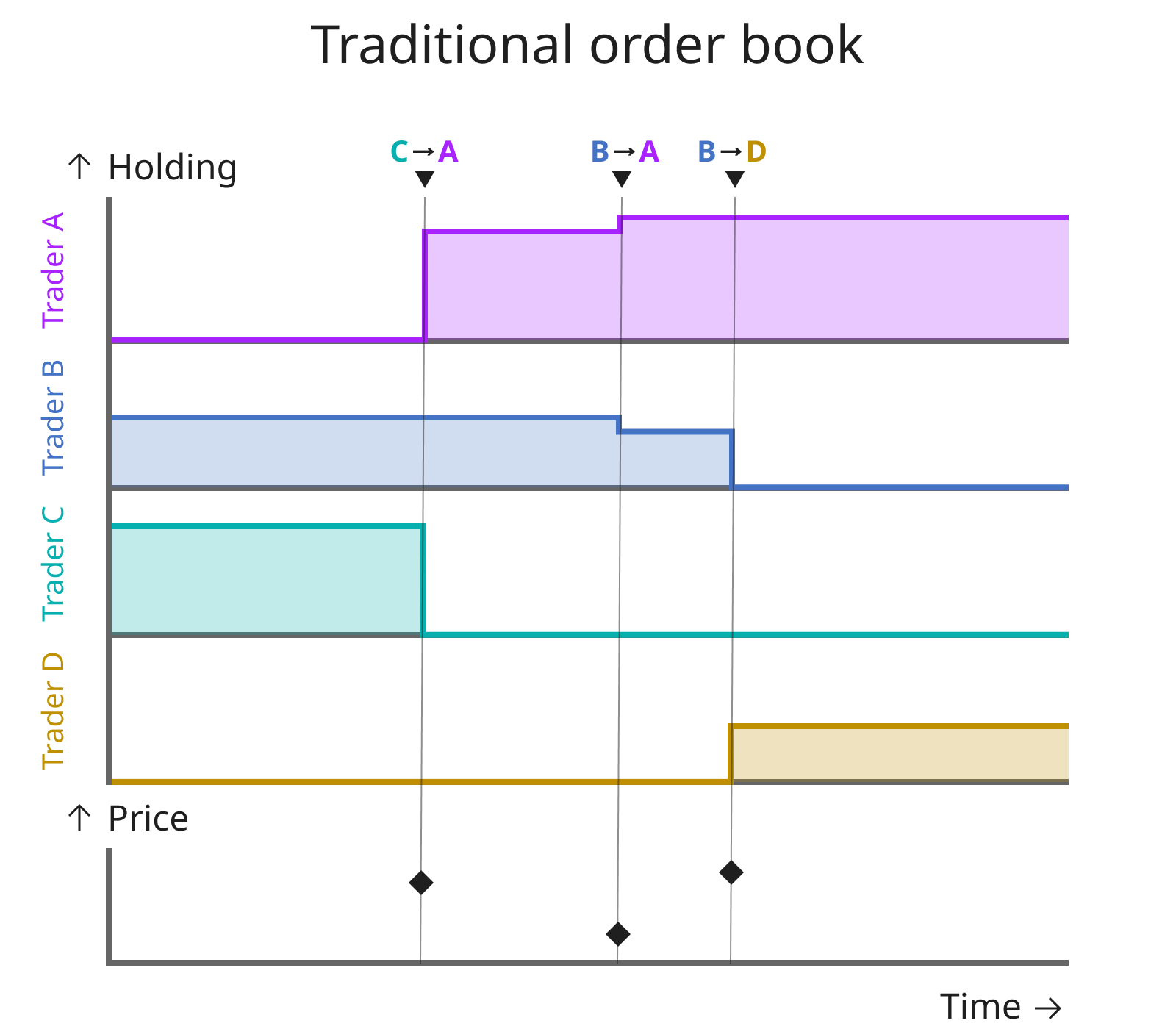

Order books amplify volatility and trading risk, often leading them to perform poorly. When orders are matched in an order book, the price jumps in an instant as chunks of supply and demand disappear. Every trade is a small shock to the market, and nanoseconds can be the difference between profit and loss. In response, traders are incentivized to shade prices or withhold volume, further reducing liquidity and increasing volatility. In effect, the incentives of order books drive a negative feedback loop that amplifies underlying volatility. Where liquidity is low and volatility is high, the consequences are commonly market failure.

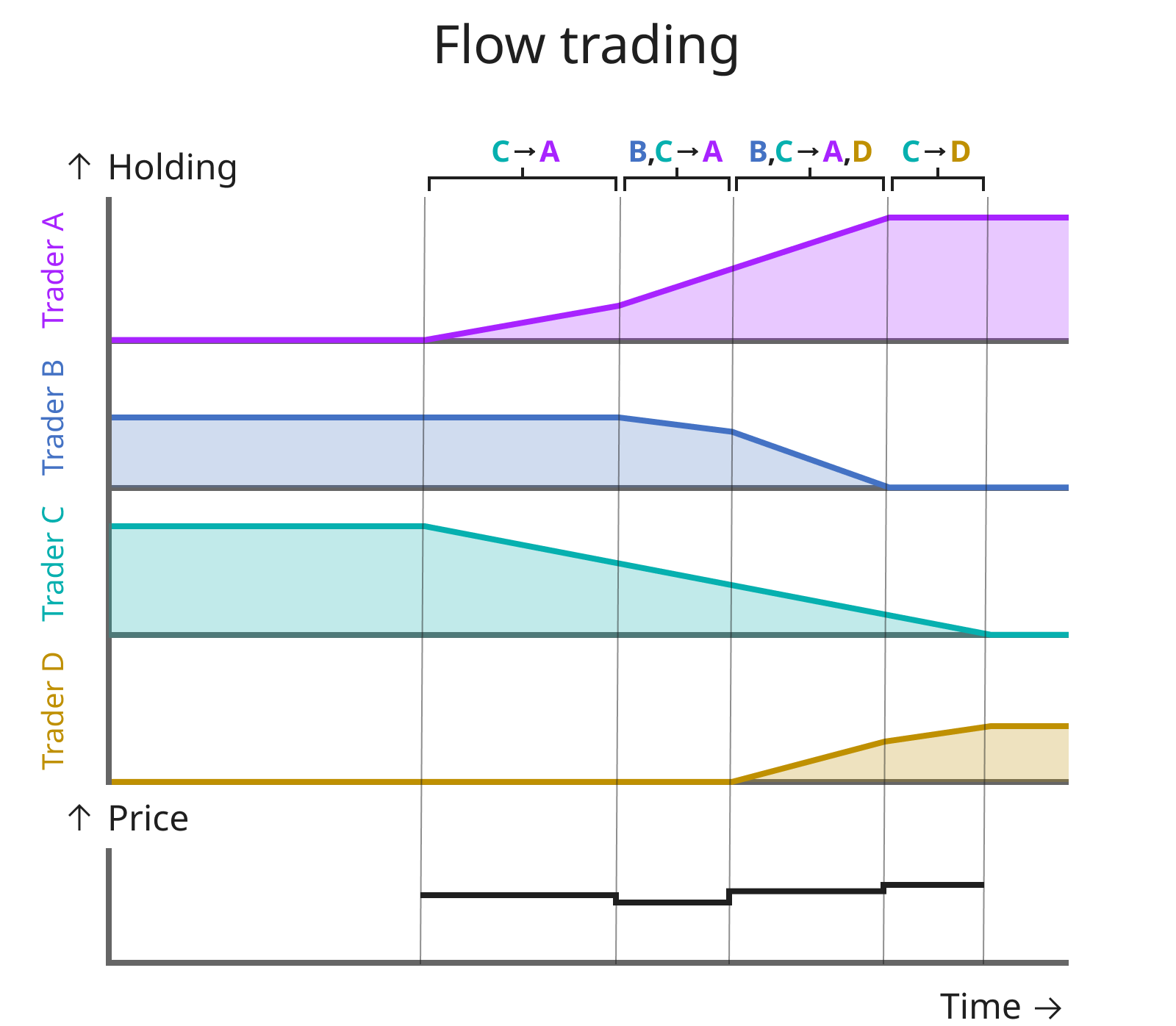

Where order books undermine trade, continuous flows enhance it. Consider the following order: Buy SPY as long as the price is at most $700. Buy at a speed of up to 10 shares/hour for 2 hours. The owner of the order will get an average price of SPY over the 2 hour window. Moreover, the order will be active in the market for 2 hours, improving liquidity by providing a consistent counterparty for other traders to sell against. Where an order book amplifies underlying volatility and increases the importance of trading speed, flow trading reduces volatility and renders nanosecond differences irrelevant. The result is a positive feedback loop that brings more trade to the market.

Note that a flow order represents continuous trade, not just decomposition of a single large order into smaller orders. Advanced traders already split orders using time-weighted average price (TWAP), volume-weighted average price (VWAP), and similar techniques. While these strategies do provide some smoothing for the trader, they do little to smooth the underlying market. To understand the difference, consider driving a nail into a piece of wood. Hitting the nail 100 times over a minute with a small amount of force will still drive the nail into the wood, as the nail “slips” into the wood with each strike. However, if constant pressure is applied over the same time, the nail will slip less. The same is true in markets—when an order is split, nanoseconds still matter for every piece of the order and slippage is a significant concern; when trade is continuous, slippage will be minimal and the market is smoothed.

Improving forward trade

Forward markets exemplify the opportunities of flow trading. Excluding the most liquid products, forward trade is thin far ahead of delivery. Order book exchanges struggle in these thin markets, with the negative feedback loop typically ensuring that little or no trade happens. Few traders are willing to be the first to put a meaningful order out at a competitive price. In contrast, flow trading creates a positive feedback loop that can unlock trade—slow and steady—much farther ahead of delivery than a traditional order book.

Improving decentralized crypto exchanges

Decentralized crypto exchanges (DEXs) are another prime opportunity for flow trading. Crypto tokens are the epitome of volatile assets, naturally pushing traders to employ TWAP, VWAP, and other complex trading strategies if they want to manage risk. On the other hand, every write or computation that happens on-chain carries real costs. DEXs, which achieve decentralization by doing as much on-chain as possible, thus find themselves in a catch-22—the complex trading strategies that address volatility risk burden the trader with high costs doing work on-chain. For most, the costs of effectively trading on a DEX outweigh the benefits.

As a consequence, most traders typically avoid DEXs and choose to trust centralized exchanges (CEXs). Only the most determined traders with the highest value for decentralized trade will endure, with DEX volume only 20% of CEX volume. Flow trading holds the potential to bring many of these mainstream traders to the DEX world by reducing trading costs.

Learn more

Flow trading has the potential to revolutionize markets that are currently choked by high volatility and low liquidity. We are actively interested in applications from energy to crypto. If you would like to learn more or have ideas for a marketplace that needs flow trading, we would love to hear from you. Email Chris Wilkens (chris.wilkens@forwardmarketdesign.com).

Thanks to Peter Cramton, David Malec, Jason Dark, and Hector Lopez for contributing to this post.